Investing for Beginners: Track Performance & Adjust Strategy

Investing for beginners involves tracking investment performance and making adjustments as needed for sustainable growth. This guide provides steps on how to monitor your investments, assess your progress, and modify your strategies to meet your financial goals.

Embarking on your investment journey can seem daunting, but with the right knowledge and strategies, you can navigate the financial markets with confidence. Investing for beginners: How to track your investment performance and make adjustments as needed is crucial for long-term success.

Why Tracking Investment Performance Matters

Tracking your investment performance is not just about knowing whether you’re making money or not; it’s about understanding how your investments are performing relative to your goals and the market. It allows you to make informed decisions, optimize your portfolio, and ultimately increase your chances of achieving financial success.

Without tracking, you’re essentially flying blind. You won’t know if your investments are on track to meet your retirement goals, if they’re underperforming compared to similar investments, or if you need to make changes to your strategy.

Identifying Strengths and Weaknesses

Tracking your investment performance helps you pinpoint which investments are performing well and which are lagging behind. This allows you to allocate more capital to the winners and consider selling or reallocating the losers.

Making Informed Decisions

With clear data on your investment performance, you can make rational decisions based on facts rather than emotions. This is especially important during market downturns, when it’s easy to panic and make hasty decisions.

Staying on Track Towards Your Goals

By regularly monitoring your progress, you can ensure that your investments are aligned with your long-term financial goals. If you’re falling behind, you can make adjustments to your strategy, such as increasing your contributions or taking on more risk.

- Regular Monitoring: Consistent tracking provides insights into your investment trends.

- Strategic Adjustments: Enables you to tweak your portfolio for optimal results.

- Financial Awareness: Enhances your understanding of market dynamics and investment behaviors.

Ultimately, tracking your investment performance is essential for taking control of your financial future. It empowers you to make smart decisions, stay on track towards your goals, and maximize your returns over the long term.

Setting Clear Financial Goals

Before you can effectively track your investment performance, you need to define what you’re trying to achieve. Setting clear financial goals provides a roadmap for your investment journey and helps you measure your progress along the way. It brings clarity and purpose to your investment decisions.

Your financial goals should be specific, measurable, achievable, relevant, and time-bound (SMART). This means that they should be clearly defined, quantifiable, realistic, aligned with your values, and have a deadline.

Examples of Financial Goals

Here are a few examples of SMART financial goals:

- Save $10,000 for a down payment on a house within the next three years.

- Accumulate $1 million in retirement savings by age 65.

- Pay off all student loan debt within the next five years.

Aligning Investments with Goals

Once you’ve set your financial goals, you need to choose investments that are appropriate for your time horizon, risk tolerance, and return expectations. For example, if you have a long time horizon and a high risk tolerance, you may be comfortable investing in stocks, which have the potential for higher returns but also carry more risk.

Revisiting and Adjusting Goals

As your circumstances change, it’s important to revisit and adjust your financial goals accordingly. For example, if you get a raise, you may want to increase your savings rate or set new goals. Or, if you experience a setback, such as a job loss, you may need to adjust your goals and timelines.

Setting clear financial goals is the foundation of successful investing. It provides direction, motivation, and a framework for measuring your progress.

Choosing the Right Tracking Tools

With well-defined financial goals in place, the next critical step is selecting the appropriate tools to monitor your investment performance. The right tools can streamline the process, providing accurate data and insightful analytics that empower you to make informed decisions.

The ideal tracking tool should offer real-time data, comprehensive reporting, and user-friendly interfaces. These features ensure that you can easily monitor your portfolio’s performance, identify trends, and assess whether you are on track to meet your goals.

Spreadsheets

Spreadsheets, such as Microsoft Excel or Google Sheets, are a flexible and customizable option for tracking your investment performance. You can create your own formulas and charts to track key metrics, such as return on investment (ROI), annual growth rate, and portfolio diversification.

Portfolio Management Software

Portfolio management software, such as Personal Capital or Mint, offers a more automated and comprehensive solution for tracking your investments. These tools can automatically import data from your brokerage accounts, track your asset allocation, and provide detailed performance reports.

- Ease of Use: Choose tools with intuitive interfaces for easy navigation.

- Comprehensive Reporting: Look for tools that offer detailed performance reports and analytics.

- Automated Data Import: Opt for software that automatically imports data from your brokerage accounts.

Online Brokerage Platforms

Most online brokerage platforms, such as Fidelity or Charles Schwab, offer built-in tools for tracking your investment performance. These tools typically provide real-time data, performance charts, and account statements.

Selecting the right tracking tools depends on your individual needs and preferences. Consider your budget, technical skills, and the level of detail you require when making your decision.

Key Metrics to Monitor

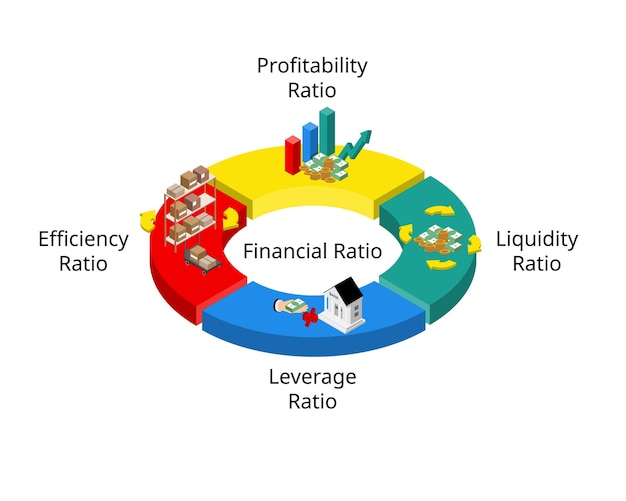

Tracking investment performance involves monitoring several key metrics to assess how your investments are performing over time. These metrics help you understand your progress, identify areas for improvement, and make informed decisions about your portfolio.

Key metrics include return on investment (ROI), annual growth rate, portfolio diversification, and risk-adjusted return. Each metric provides unique insights into your investment performance and helps you evaluate your progress towards your financial goals.

Return on Investment (ROI)

ROI measures the profitability of your investments relative to their cost. It is calculated by dividing the net profit by the initial investment. A higher ROI indicates a more profitable investment.

Annual Growth Rate

The annual growth rate measures the percentage increase in the value of your investments over a one-year period. It provides a standardized way to compare the performance of different investments.

By monitoring these key metrics, you can gain a comprehensive understanding of your investment performance and make informed decisions about your portfolio.

Portfolio Diversification

Portfolio diversification measures the extent to which your investments are spread across different asset classes, such as stocks, bonds, and real estate. A well-diversified portfolio can help reduce risk and improve returns.

- Risk Management: Diversification minimizes the impact of any single investment’s performance on your overall portfolio.

- Performance Comparison: ROI allows you to compare the profitability of different investments.

- Goal Adjustment: By monitoring these metrics, one can be prepared to adjust their goals based on performance.

Risk Factors of Investments

Risk-adjusted return measures the return on your investments relative to the amount of risk you have taken. It helps you evaluate whether you are being adequately compensated for the risk you are taking.

Analyzing Your Investment Performance

Once you’ve been tracking your investment performance for a while, it’s time to analyze the data and draw some conclusions. This involves comparing your performance to your goals, benchmarks, and other similar investments. The objective here is to gain actionable insights that can inform future investment decisions.

Start by comparing your actual returns to your expected returns. Were you expecting a 10% annual return, but only achieved 5%? This discrepancy warrants further investigation. It could be due to market conditions, poor investment choices, or a combination of both.

Comparing to Benchmarks

Benchmarks provide a useful point of reference for evaluating your performance. For example, if you’re investing in the S&P 500, you can compare your returns to the S&P 500 index. If you’re investing in bonds, you can compare your returns to a bond index.

Adjusting Your Strategy

Based on your analysis, you may need to make adjustments to your investment strategy. This could involve reallocating your assets, changing your investment selections, or increasing your contributions. This process allows for a dynamic investment approach that aligns with personal circumstances and market trends.

- Regular Evaluation: Conduct regular performance reviews to identify areas needing improvement.

- Market Awareness: Stay informed about market trends and their potential impact on your portfolio.

- Flexibility: Be prepared to adjust your investment strategy based on market conditions.

Seeking Professional Advice

If you’re unsure how to analyze your investment performance or make adjustments to your strategy, consider seeking professional advice from a financial advisor. A financial advisor can help you develop a personalized investment plan and provide guidance on how to achieve your financial goals.

Analyzing your investment performance is an ongoing process. By regularly monitoring your progress and making adjustments as needed, you can increase your chances of achieving financial success.

Making Adjustments to Your Portfolio

The final step is to make necessary adjustments to your investment portfolio based on your analysis. This might involve rebalancing your assets, changing your investment selections, or increasing your contributions. Adjusting your portfolio is proactive portfolio management.

Rebalancing involves bringing your portfolio back to its target asset allocation. As your investments grow, some asset classes may become overrepresented, while others may become underrepresented. Rebalancing helps you maintain your desired level of risk and return.

Rebalancing regularly

Changing your investment selections involves buying or selling investments based on your analysis. For example, if you’ve identified an underperforming investment, you may want to sell it and reallocate the capital to a more promising investment.

Increasing your contribution

Increasing your contributions involves adding more money to your investment portfolio. This can help you reach your financial goals faster, especially if you’re starting to fall behind. In some cases, it may be wise to simply diversify your investment.

By regularly adjusting your portfolio, you can optimize your returns, manage your risk, and stay on track towards your financial goals.

- Diversify: To mitigate risk, spread investments accross various asset classes.

- Balance Adjustments: This ensures risk levels align to the individual’s requirement.

- Adaptability: One must be ready to change strategy in line with evolving financial ambitions.

Seeking Professional Advice (Again)

If you’re unsure how to make adjustments to your portfolio, consider seeking professional advice from a financial advisor which can provide tailored recommendations based on your specific circumstances.

Making adjustments to your portfolio is an ongoing process. By regularly monitoring your progress and making changes as needed, you can increase your chances of achieving financial success.

| Key Point | Brief Description |

|---|---|

| 🎯 Set Goals | Define SMART financial goals for a clear investment roadmap. |

| 📊 Track Metrics | Monitor ROI, growth rate, and diversification to evaluate performance. |

| 🛠️ Adjustments | Rebalance assets and modify investments as needed. |

| 🧭 Seek Advice | Consult a financial advisor for personalized guidance. |

Frequently Asked Questions

Tracking your investment performance helps you understand if you’re on track to meet your financial goals, identify areas for improvement, and make informed decisions based on data rather than emotions.

Key metrics to monitor include return on investment (ROI), annual growth rate, portfolio diversification, and risk-adjusted return. These metrics provide a comprehensive view of your investment performance.

You should review your investment performance at least quarterly. However, more frequent monitoring may be necessary if you are actively managing your portfolio or if market conditions are volatile.

You can use spreadsheets, portfolio management software, or online brokerage platforms to track your investment performance. Choose a tool that meets your needs and provides the data and analytics you require.

You should make adjustments to your investment portfolio when your performance deviates significantly from your expectations, when your financial goals change, or when market conditions warrant a change in strategy.

Conclusion

Tracking your investment performance and making adjustments as needed is essential for achieving your financial goals. By setting clear goals, choosing the right tracking tools, monitoring key metrics, analyzing your performance, and making necessary adjustments, you can take control of your financial future and maximize your returns over the long term.