US Housing Starts Surge: Analyzing the 15% Economic Impact

The recent 15% surge in new housing starts in the US signals potential economic growth, driven by increased construction activity, job creation, and consumer confidence, impacting both the housing market and broader economic indicators.

The US housing market has recently experienced a significant upturn, with new housing starts surge: what the 15% increase signals for the US economy becoming a focal point of economic discussions. This notable rise prompts a deeper exploration into the factors driving this growth and its potential consequences for the overall economic landscape.

Understanding the Housing Starts Surge

The increase in housing starts reflects a renewed vigor in the construction sector. This surge doesn’t just mean more homes being built; it signifies a ripple effect that extends to various facets of the economy. Let’s delve into the underlying causes and potential impacts of this upward trend.

What are Housing Starts?

Housing starts are a key economic indicator that tracks the number of new residential construction projects that have begun in a given period. It’s a forward-looking metric, offering insights into future housing supply and overall economic health.

Why is the 15% Increase Significant?

A 15% increase is substantial, indicating a strong demand for housing and a favorable environment for construction. This rise can stimulate economic activity, create jobs, and boost consumer confidence.

Here are some factors driving the new housing starts surge:

- Low Interest Rates: Favorable borrowing conditions make it easier for developers to finance new projects and for individuals to purchase homes.

- Increased Demand: Population growth, urbanization, and changing household sizes contribute to the demand for housing.

- Economic Recovery: A strengthening economy boosts consumer confidence and encourages investment in real estate.

In conclusion, understanding the housing starts surge involves recognizing the interconnected factors that drive construction activity and the positive implications for economic growth.

Interest Rates and Housing Affordability

Interest rates play a pivotal role in shaping housing affordability and demand. The relationship between these factors can significantly influence the new housing starts surge and the overall health of the housing market.

The Impact of Low Interest Rates

Low interest rates reduce the cost of borrowing, making mortgages more affordable and stimulating demand for homes. This increased demand often translates into more construction activity and higher housing starts.

Rising Interest Rates and Their Effects

Conversely, rising interest rates can dampen demand by increasing borrowing costs. This can lead to a slowdown in housing starts as developers become more cautious about investing in new projects.

Here are different dynamics of interest rates and housing affordability:

- Mortgage Rates: Changes in mortgage rates directly affect the monthly payments for homebuyers, influencing their ability to afford a home.

- Refinancing Activity: Lower rates encourage homeowners to refinance their mortgages, freeing up disposable income and potentially boosting consumer spending.

- Investment Decisions: Developers weigh interest rates when deciding whether to initiate new construction projects.

In conclusion, interest rates are a critical determinant of housing affordability and demand, influencing the new housing starts surge and the broader economic landscape.

The Role of Government Policies

Government policies related to housing, zoning, and construction significantly impact the new housing starts surge and the overall dynamics of the housing market. Understanding these policies is crucial to assessing the current increase.

Zoning Regulations and Their Influence

Zoning regulations dictate what types of housing can be built in specific areas. Restrictive zoning can limit the supply of new homes, while more permissive zoning can encourage construction.

Government Incentives and Subsidies

Government incentives, such as tax credits for developers or subsidies for homebuyers, can stimulate the housing market and contribute to a new housing starts surge. These policies aim to make housing more accessible and affordable.

Here are a few different types of government policies to consider:

- Tax Incentives: Tax breaks for developers who build affordable housing or for individuals who purchase homes.

- Infrastructure Investments: Government spending on roads, utilities, and other infrastructure that supports new housing developments.

- Regulations and Permits: Streamlining the permitting process to reduce delays and costs for builders.

In summary, government policies play a crucial role in influencing the new housing starts surge and shaping the housing market’s ability to meet demand.

Impact on Job Creation

The construction industry is a significant source of employment, and the new housing starts surge has a direct and positive impact on job creation. Increased construction activity leads to more jobs in various sectors.

Direct Employment in Construction

Building new homes requires a wide range of skilled workers, including carpenters, plumbers, electricians, and construction managers. A surge in housing starts translates to more jobs in these trades.

Indirect Employment Effects

Beyond direct construction jobs, the new housing starts surge creates indirect employment opportunities in related industries, such as manufacturing of building materials, transportation, and real estate services.

The construction industry contributes with the following figures to job creation:

- Construction Jobs: Increased demand for construction workers across various trades.

- Supplier Jobs: More jobs in manufacturing and supplying building materials.

- Service Jobs: Growth in real estate, finance, and other services supporting the housing market.

Therefore, the new housing starts surge not only boosts the housing market but also has a ripple effect, creating jobs and stimulating economic growth across multiple sectors.

Supply Chain Considerations

The availability and cost of building materials play a critical role in determining the feasibility and pace of new construction. The new housing starts surge is closely linked to the stability of supply chains.

Availability of Building Materials

Shortages of essential materials, such as lumber, steel, and concrete, can delay construction projects and increase costs. Efficient supply chains are essential to ensure a smooth construction process.

Cost of Materials and Its Impact

Fluctuations in the cost of building materials can significantly impact the affordability of new homes. High material costs can deter developers from starting new projects or force them to raise prices.

Here are some factors influencing supply chain and material costs:

- Global Trade: International trade policies and tariffs can affect the cost and availability of imported building materials.

- Production Capacity: The ability of manufacturers to meet the demand for building materials.

- Transportation Costs: The cost of transporting materials from suppliers to construction sites.

In conclusion, the new housing starts surge is contingent on the stability and efficiency of supply chains and the availability of affordable building materials.

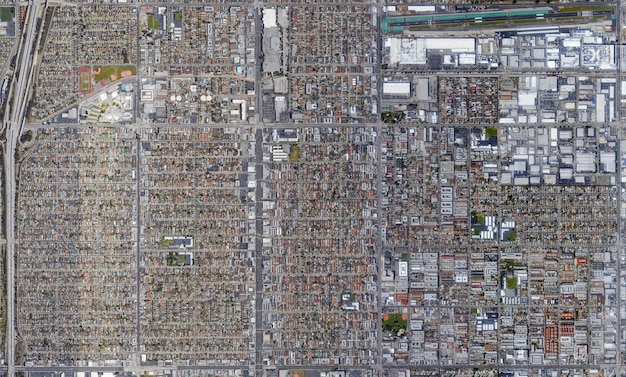

Regional Variations

Housing markets in the US are diverse, and the new housing starts surge may not be uniform across all regions. Different factors can influence construction activity in various parts of the country.

Factors Influencing Regional Housing Markets

Economic conditions, population growth, climate, and local regulations can all affect housing demand and construction activity in different regions. Some areas may experience a more pronounced new housing starts surge than others.

Areas with High Growth

Regions with strong job markets, affordable living costs, and favorable business environments tend to attract more residents and experience higher demand for housing. These areas are often at the forefront of a new housing starts surge.

Here are examples of the regional variables in housing markets:

- Sun Belt States: States like Texas, Florida, and Arizona are experiencing rapid population growth and increased housing demand.

- Urban Centers: Major cities like New York, San Francisco, and Boston face unique challenges related to high living costs and limited space.

- Rural Areas: Rural communities may see slower growth and different housing needs compared to urban areas.

Therefore, understanding regional variations is essential to fully grasp the implications of the new housing starts surge on the US economy.

Future Outlook

The new housing starts surge reflects a dynamic interplay of economic forces, government policies, and regional factors. Looking ahead, several trends and uncertainties will shape the future of the housing market.

Anticipated Trends

Demographic shifts, technological advancements in construction, and evolving consumer preferences will continue to influence housing demand and construction practices. Additionally, sustainable building practices are likely to gain prominence.

Potential Challenges and Uncertainties

Economic downturns, rising interest rates, supply chain disruptions, and regulatory changes could pose challenges to sustained growth in the housing market. Careful monitoring and adaptive strategies will be necessary to navigate these uncertainties.

Some key areas to watch over the long term in the US economy include:

- Technological Innovation: Adoption of new construction methods like 3D printing and modular construction.

- Sustainable Building: Increasing demand for green building materials and energy-efficient homes.

- Demographic Shifts: Changing household sizes and preferences as Millennials and Gen Z enter the housing market.

In conclusion, the future of the housing market depends on a confluence of factors. By understanding these dynamics, stakeholders can position themselves to navigate the challenges and capitalize on the opportunities that lie ahead.

| Key Point | Brief Description |

|---|---|

| 📈 Housing Starts Increase | A 15% surge indicates strong demand and construction activity. |

| 💰 Interest Rates Impact | Low rates boost affordability; rising rates dampen demand. |

| 👷 Job Creation | New construction creates direct and indirect employment. |

| 🏛️ Government Policies | Zoning, incentives, and regulations shape housing supply. |

FAQ Section

▼

Housing starts measure the number of new residential construction projects that have begun during a particular month. It serves as a key indicator of economic activity and potential future housing supply.

▼

A 15% increase is considered substantial because it signals strong demand for housing and a favorable environment for construction. This growth can stimulate economic activity and boost consumer confidence.

▼

Low interest rates reduce the cost of borrowing, making mortgages more affordable and stimulating demand. Conversely, rising interest rates can dampen demand by increasing borrowing costs for potential homebuyers.

▼

Government policies related to zoning, construction, and incentives can significantly influence housing starts. Permissive zoning and tax incentives can encourage construction, while restrictive regulations can limit supply.

▼

Increased construction activity creates direct employment for construction workers, such as carpenters and electricians, as well as indirect employment in related industries like manufacturing and real estate services.

Conclusion

In summary, the recent surge in US housing starts is a multifaceted economic indicator, driven by a combination of low interest rates, rising demand, and government policies. While it signals positive trends for job creation and economic growth, challenges such as supply chain considerations and regional variations must be carefully monitored to ensure sustained progress in the housing market.