Diversification for Beginner Investors: Your 2025 Guide

Diversification in 2025 is crucial for beginner investors to mitigate risk by spreading investments across various asset classes, industries, and geographic regions, maximizing potential returns while minimizing the impact of any single investment’s underperformance.

Embarking on your investment journey? Understanding what every beginner investor needs to know about diversification in 2025 is paramount. It’s the bedrock of a resilient portfolio, ensuring you can navigate the market’s ups and downs with greater confidence.

Understanding the Basics of Diversification

Diversification is not just a buzzword; it’s a fundamental strategy for managing risk in investing. It’s about not putting all your eggs in one basket, so to speak. By spreading your investments across different assets, you reduce the impact of any single investment performing poorly.

Think of it like this: If you only invest in one company, and that company encounters financial difficulties, your entire investment could be at risk. However, if you diversify across multiple companies and sectors, the negative impact of one underperforming investment can be offset by the positive performance of others.

Why Diversification Matters More Than Ever in 2025

In the rapidly evolving financial landscape of 2025, diversification is even more critical. Market volatility, economic uncertainties, and the emergence of new asset classes like cryptocurrencies demand a more nuanced approach to portfolio construction.

- Market Volatility: With increasing global interconnectedness, markets are more susceptible to shocks and unexpected events. Diversification can cushion your portfolio against these fluctuations.

- Economic Uncertainties: Factors like inflation, interest rate changes, and geopolitical tensions can significantly impact investment returns. A diversified portfolio can help you weather these storms.

- Emerging Asset Classes: The rise of cryptocurrencies, NFTs, and other digital assets presents both opportunities and risks. Diversifying into these new asset classes requires careful consideration and a balanced approach.

Therefore, understanding the principles of diversification and implementing them effectively can significantly enhance your long-term investment success.

In conclusion, diversification is crucial for beginner investors in 2025 as it helps mitigate risk and navigate increasing market volatility and economic uncertainties, securing their long-term investments.

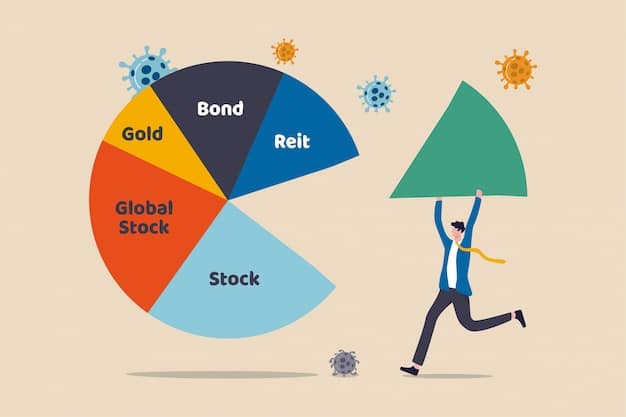

Asset Allocation: The Foundation of Diversification

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. This is a crucial step in diversification, as different asset classes tend to perform differently under various economic conditions.

For instance, stocks generally offer higher potential returns but also carry greater risk, while bonds are typically less volatile but offer lower returns. The right asset allocation strategy depends on your risk tolerance, investment goals, and time horizon.

Matching Asset Allocation to Your Risk Tolerance

Determining your risk tolerance is essential for creating an appropriate asset allocation strategy. Are you comfortable with the possibility of losing a significant portion of your investment in exchange for potentially higher returns, or do you prefer a more conservative approach that prioritizes capital preservation?

Here’s a general guideline:

- Conservative Investors: Typically allocate a larger portion of their portfolio to bonds and cash, with a smaller allocation to stocks.

- Moderate Investors: Aim for a balanced mix of stocks and bonds, with a moderate allocation to alternative investments.

- Aggressive Investors: Are comfortable with a higher allocation to stocks, with smaller allocations to bonds and cash.

Keep in mind that your risk tolerance can change over time, so it’s important to reassess your asset allocation strategy periodically.

In conclusion, asset allocation forms the basis of diversification by strategically distributing investments across various asset classes, tailored to individual risk tolerance, thereby optimizing potential returns while managing risk.

Diversifying Within Asset Classes

While asset allocation focuses on diversifying across different asset classes, it’s also important to diversify within each asset class. For example, instead of investing in just one stock, you should invest in a variety of stocks across different industries and market capitalizations.

This helps to reduce the risk associated with any single company or sector performing poorly. Similarly, you can diversify within the bond market by investing in different types of bonds, such as government bonds, corporate bonds, and municipal bonds.

Strategies for Diversifying Stock Investments

There are several ways to diversify your stock investments. One common approach is to invest in index funds or exchange-traded funds (ETFs) that track a broad market index, such as the S&P 500. These funds provide instant diversification across a wide range of companies.

Another strategy is to invest in individual stocks across different sectors, such as technology, healthcare, finance, and consumer goods. This allows you to gain exposure to different areas of the economy and reduce your reliance on any single sector.

- Invest in Index Funds or ETFs: These funds offer instant diversification across a broad range of companies.

- Diversify Across Sectors: Investing in different sectors reduces your reliance on any single industry.

- Consider Market Capitalization: Include a mix of small-cap, mid-cap, and large-cap stocks in your portfolio.

By implementing these strategies, you can create a more diversified and resilient stock portfolio.

In conclusion, diversifying within asset classes, particularly stocks, is essential for mitigating risk by spreading investments across various sectors and market capitalizations, thereby enhancing portfolio stability and potential returns.

Geographic Diversification: Expanding Your Horizons

Geographic diversification involves investing in assets located in different countries or regions. This can help to reduce the risk associated with economic or political instability in any one particular country.

For instance, if you only invest in domestic stocks, your portfolio could be significantly impacted by a recession or political upheaval in your home country. However, by diversifying internationally, you can reduce your exposure to these risks.

The Benefits of International Investing

International investing offers several potential benefits, including access to new growth opportunities, reduced correlation with domestic markets, and exposure to different currencies.

Emerging markets, in particular, can offer high growth potential, but they also come with greater risks. Developed international markets, such as Europe and Japan, can provide more stability and diversification benefits.

- Access to New Growth Opportunities: International markets can offer higher growth potential than domestic markets.

- Reduced Correlation with Domestic Markets: International assets may perform differently than domestic assets, providing diversification benefits.

- Exposure to Different Currencies: Investing in foreign assets can provide exposure to different currencies, which can act as a hedge against currency fluctuations.

When considering international investments, it’s important to research the economic and political conditions of the countries you’re investing in, as well as the currency risks involved.

In conclusion, geographic diversification broadens investment horizons by including assets from various regions, minimizing the impact of local economic or political instability and enhancing overall portfolio resilience.

Rebalancing Your Portfolio: Maintaining Your Strategy

Over time, your asset allocation may drift away from your target allocation due to differences in the performance of various asset classes. For example, if stocks perform well, they may become a larger portion of your portfolio than you originally intended.

Rebalancing involves adjusting your portfolio to bring it back in line with your target allocation. This typically involves selling some of the overperforming assets and buying more of the underperforming assets.

The Importance of Regular Rebalancing

Rebalancing is an essential part of maintaining a diversified portfolio. It helps to ensure that you’re not taking on more risk than you’re comfortable with and that you’re staying on track to meet your investment goals.

There are several different strategies for rebalancing your portfolio. Some investors choose to rebalance on a fixed schedule, such as annually or semi-annually. Others rebalance when their asset allocation deviates from their target allocation by a certain percentage.

- Maintain Your Target Allocation: Rebalancing helps to ensure that your portfolio remains aligned with your risk tolerance and investment goals.

- Control Risk: By selling overperforming assets and buying underperforming assets, you can reduce your exposure to risk.

- Stay Disciplined: Rebalancing can help you avoid making emotional investment decisions based on short-term market fluctuations.

Regardless of the strategy you choose, it’s important to rebalance your portfolio regularly to maintain your desired asset allocation.

In conclusion, rebalancing is vital for maintaining a diversified portfolio by realigning asset allocations to their target levels, controlling risk, and ensuring continued alignment with investment objectives.

Tools and Resources for Beginner Investors in 2025

In 2025, beginner investors have access to a wide range of tools and resources that can help them learn about diversification and implement effective investment strategies. These include online brokers, robo-advisors, financial education websites, and investment apps.

Online brokers offer a low-cost way to buy and sell stocks, bonds, and other investments. Robo-advisors provide automated investment management services based on your risk tolerance and investment goals. Financial education websites offer valuable information and resources for learning about investing.

Leveraging Technology for Diversification

Technology has made it easier than ever for beginner investors to diversify their portfolios. Robo-advisors can automatically allocate your investments across different asset classes and rebalance your portfolio regularly. Investment apps allow you to buy fractional shares of stocks, making it easier to diversify even with a small amount of capital.

Some popular tools and resources include:

- Online Brokers: Companies like Fidelity, Charles Schwab, and Robinhood offer low-cost trading platforms.

- Robo-Advisors: Services like Betterment and Wealthfront provide automated investment management.

- Financial Education Websites: Websites like Investopedia and NerdWallet offer valuable information and resources for beginner investors.

By leveraging these tools and resources, beginner investors can gain the knowledge and skills they need to build diversified portfolios and achieve their financial goals.

In conclusion, beginner investors in 2025 can leverage various tools and resources like online brokers, robo-advisors, and financial education websites to enhance their understanding and implementation of effective diversification strategies.

| Key Point | Brief Description |

|---|---|

| 🎯 Asset Allocation | Distribute investments across stocks, bonds, and cash based on your risk tolerance. |

| 🌎 Geographic Diversification | Invest in assets from different countries to reduce risk from local instability. |

| ⚖️ Rebalancing | Regularly adjust your portfolio to maintain your target asset allocation. |

| 🛠️ Tools & Resources | Use online brokers, robo-advisors, and educational websites to aid your investment strategy. |

Frequently Asked Questions (FAQ)

▼

Diversification is spreading investments across various assets to reduce risk. It’s important because it minimizes the impact of any single investment performing poorly, ensuring a more stable portfolio.

▼

Asset allocation is the foundation of diversification. It involves dividing your portfolio among different asset classes like stocks, bonds, and cash based on your risk tolerance and investment goals.

▼

Strategies include investing in index funds or ETFs, diversifying across sectors (e.g., technology, healthcare), and considering market capitalization (small-cap, mid-cap, large-cap stocks) for a balanced portfolio.

▼

Geographic diversification reduces risk by investing in assets located in different countries. This minimizes the impact of economic or political instability in any single country, improving portfolio resilience.

▼

Rebalancing should be done regularly, either on a fixed schedule (e.g., annually) or when your asset allocation deviates from your target by a certain percentage, ensuring your portfolio remains aligned with your goals.

Conclusion

Understanding and implementing diversification is essential for every beginner investor in 2025. By spreading your investments wisely, managing your asset allocation, and staying informed, you can build a resilient portfolio that stands the test of time and helps you achieve your financial goals.