Rebalancing Your Portfolio: A Beginner’s Guide to Annual Adjustments

Investing for beginners often involves setting a target asset allocation and periodically rebalancing your portfolio to maintain that allocation, ensuring your investments stay aligned with your risk tolerance and financial goals.

For beginners venturing into the world of investing, maintaining a balanced portfolio is crucial. Investing for beginners: How to rebalance your portfolio annually to maintain your target allocation is a strategy that ensures your investments stay aligned with your financial goals and risk tolerance over time.

Understanding Asset Allocation for Beginners

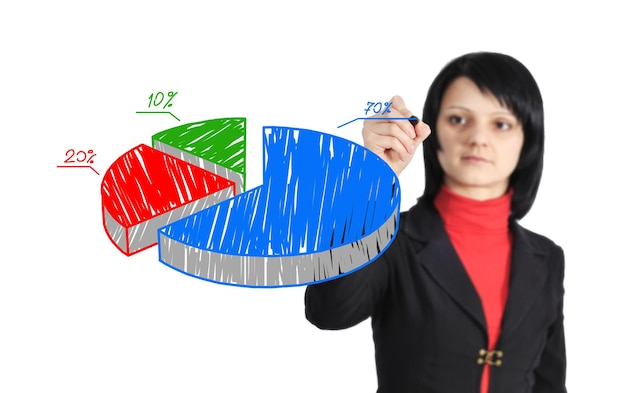

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. The right asset allocation depends on several factors, including your financial goals, time horizon, and risk tolerance.

For instance, a young investor with a long time horizon might choose a more aggressive asset allocation with a higher percentage of stocks, which have the potential for higher returns but also come with greater risk. On the other hand, an older investor nearing retirement might prefer a more conservative asset allocation with a higher percentage of bonds, which tend to be less volatile.

Why Asset Allocation Matters

Asset allocation is crucial because it can significantly impact your investment returns and risk exposure. By diversifying your investments across different asset classes, you can reduce the overall risk of your portfolio.

Different asset classes tend to perform differently under various market conditions. For example, during an economic downturn, stocks might decline in value, while bonds might hold their value or even increase. By having a mix of assets, you can cushion the impact of market fluctuations on your portfolio.

To summarize, asset allocation involves thoughtfully dividing investments among diverse classes, such as stocks and bonds, mitigating risk and aligning with financial goals.

The Importance of Rebalancing Annually

Over time, your initial asset allocation can drift away from your target due to market fluctuations. Some assets might outperform others, causing your portfolio to become overweighted in certain areas and underweighted in others. This is where rebalancing comes in.

Rebalancing involves selling some of your overperforming assets and buying more of your underperforming assets to bring your portfolio back to its original target allocation. This process helps you maintain your desired level of risk and stay on track to achieve your financial goals.

Benefits of Annual Rebalancing

Rebalancing your portfolio annually offers several benefits. First, it helps you maintain your desired level of risk. As your portfolio drifts away from your target allocation, your risk exposure can increase. Rebalancing brings your portfolio back into alignment, ensuring that you are not taking on more risk than you are comfortable with.

Second, rebalancing can help you improve your long-term returns. By selling high and buying low, you are essentially taking profits from your overperforming assets and reinvesting them in undervalued assets. This can help you capture gains and potentially boost your overall returns over time.

- Maintaining desired risk level

- Improving long-term returns

- Staying disciplined with investment strategy

In essence, annual rebalancing restores your portfolio to target allocation, reducing risk exposure and capturing gains from selling high and buying low.

Steps to Rebalance Your Portfolio

Rebalancing your portfolio might seem daunting, but it is a straightforward process that can be broken down into a few simple steps. Here’s how to do it:

First, determine your target asset allocation. This is the mix of assets that you want to maintain in your portfolio based on your financial goals, time horizon, and risk tolerance.

Next, assess your current asset allocation. This involves calculating the percentage of each asset class in your portfolio. You can do this manually or use a portfolio tracking tool.

Calculating Your Current Allocation

To calculate your current asset allocation, divide the total value of each asset class by the total value of your portfolio. For example, if you have $50,000 in stocks, $30,000 in bonds, and $20,000 in cash, your asset allocation would be 50% stocks, 30% bonds, and 20% cash.

Once you have calculated your current asset allocation, compare it to your target asset allocation. Identify which asset classes are overweighted and which are underweighted.

To summarize, rebalancing involves determining target allocation, assessing current allocation, and identifying deviations. It’s a repetitive cycle.

Methods for Rebalancing

There are several methods you can use to rebalance your portfolio. The most common include:

Selling overperforming assets and buying underperforming assets. This involves selling some of the assets that have increased in value above your target allocation and using the proceeds to buy more of the assets that have fallen below your target allocation.

Investing new money strategically. Instead of rebalancing by selling assets, you can use new money to buy the underweight assets and bring your portfolio back into balance. This can be a tax-efficient way to rebalance.

- Selling overperforming assets

- Buying underperforming assets

- Investing new money strategically

Therefore, rebalancing can be conducted through selling high, buying low, or strategically allocating new funds to underweight assets.

Tax Implications of Rebalancing

Rebalancing your portfolio can have tax implications, especially if you are selling assets in a taxable account. When you sell an asset for more than you paid for it, you will incur a capital gain, which is subject to taxes.

To minimize the tax impact of rebalancing, consider the following strategies. First, rebalance within tax-advantaged accounts, such as 401(k)s and IRAs, where capital gains are not taxed until you withdraw the money in retirement. Second, use tax-loss harvesting, which involves selling assets at a loss to offset capital gains.

Minimizing Tax Impact

Another strategy to minimize the tax impact is to use the “asset location” approach, which involves holding your most tax-efficient assets (such as stocks) in taxable accounts and your least tax-efficient assets (such as bonds) in tax-advantaged accounts. This can help you reduce your overall tax bill.

Remember to consult with a tax advisor to understand the specific tax implications of rebalancing your portfolio based on your individual circumstances.

Hence, rebalancing requires awareness of potential tax implications, necessitating strategies like rebalancing within tax-advantaged accounts, tax-loss harvesting, and asset location.

Tools and Resources for Rebalancing

Several tools and resources can assist you in rebalancing your portfolio. These include:

Portfolio tracking software. Many online brokers and financial institutions offer portfolio tracking tools that can help you monitor your asset allocation and identify when it’s time to rebalance.

Robo-advisors. Robo-advisors are automated investment platforms that build and manage your portfolio based on your financial goals and risk tolerance. Most robo-advisors automatically rebalance your portfolio on a regular basis.

Financial advisors. A financial advisor can provide personalized advice on asset allocation and rebalancing strategies, taking into account your individual circumstances and goals.

To conclude, various resources, such as portfolio tracking software, robo-advisors, and financial advisors, can aid in the rebalancing process.

| Key Point | Brief Description |

|---|---|

| 🎯 Asset Allocation | Investing in various asset classes like stocks, bonds, and cash based on risk tolerance. |

| ⚖️ Rebalancing | Adjusting your portfolio annually to maintain your target asset allocation. |

| 💰 Tax Implications | Consider taxes when rebalancing; use tax-advantaged accounts. |

| 🛠️ Tools | Utilize portfolio tracking software, robo-advisors, or financial advisors. |

Frequently Asked Questions

▼

Rebalancing ensures your portfolio aligns with your desired risk level and investment goals. It prevents over-exposure to any single asset class, mitigating potential losses during market fluctuations.

▼

Annually is a good rule of thumb, but more frequent rebalancing might be necessary during volatile market conditions. Consult with a financial advisor to determine the best approach.

▼

Selling assets to rebalance can trigger capital gains taxes. Try to rebalance within tax-advantaged accounts first, or use tax-loss harvesting to offset gains.

▼

Yes, you can. Start by calculating your current asset allocation and comparing it to your target. Then, buy or sell assets accordingly to realign your portfolio.

▼

If you don’t have enough funds, focus on rebalancing with new contributions. Direct new investments to the underweighted assets to help bring your portfolio back into balance.

Conclusion

Rebalancing your portfolio annually is a crucial step for beginners to keep their investments aligned with their financial goals and risk tolerance. By understanding asset allocation, following a disciplined rebalancing strategy, and considering the tax implications, you can build a resilient portfolio that stands the test of time.